Asphalt Ridge

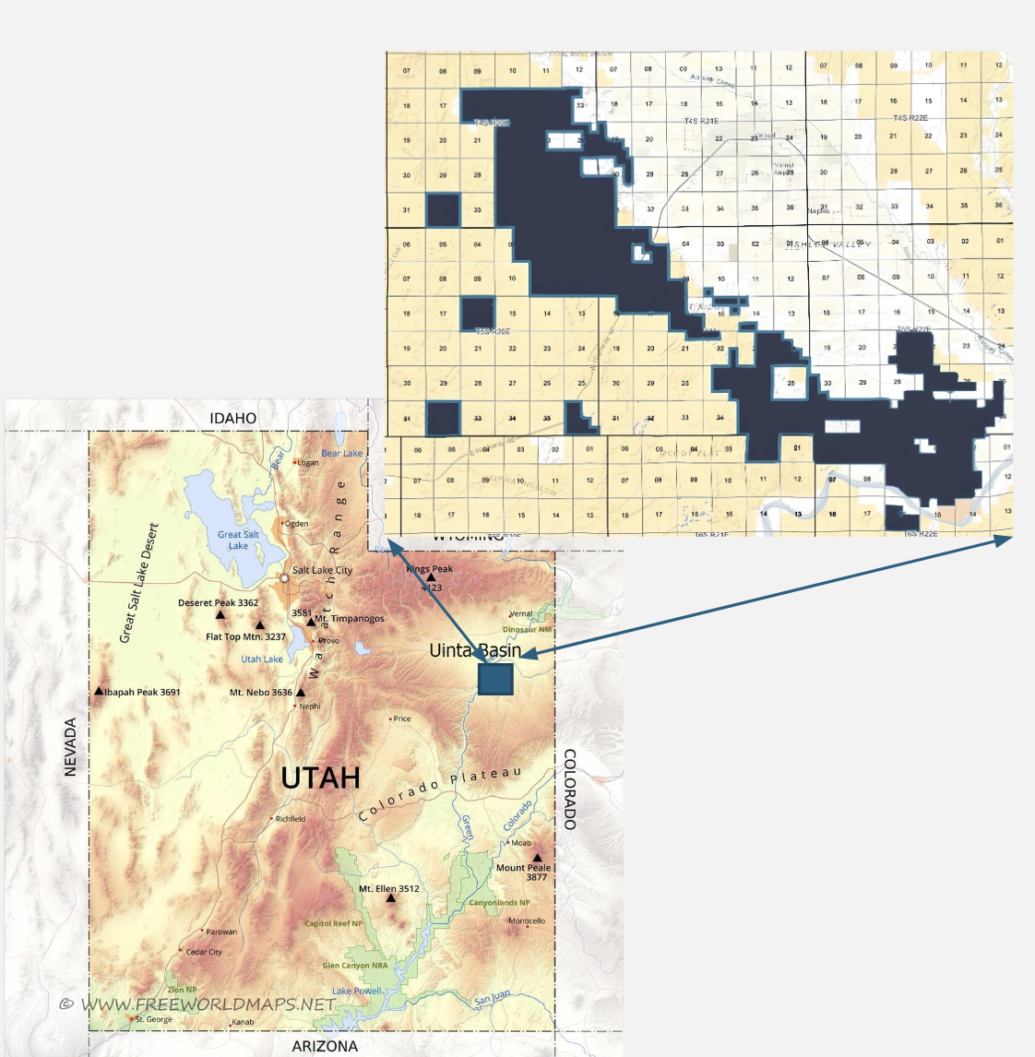

Asphalt Ridge: 2,880 Acres

Phase 1: 240 Acres

- Asphalt Ridge is located in the Uinta Basin – 3 Miles from Vernal, Utah

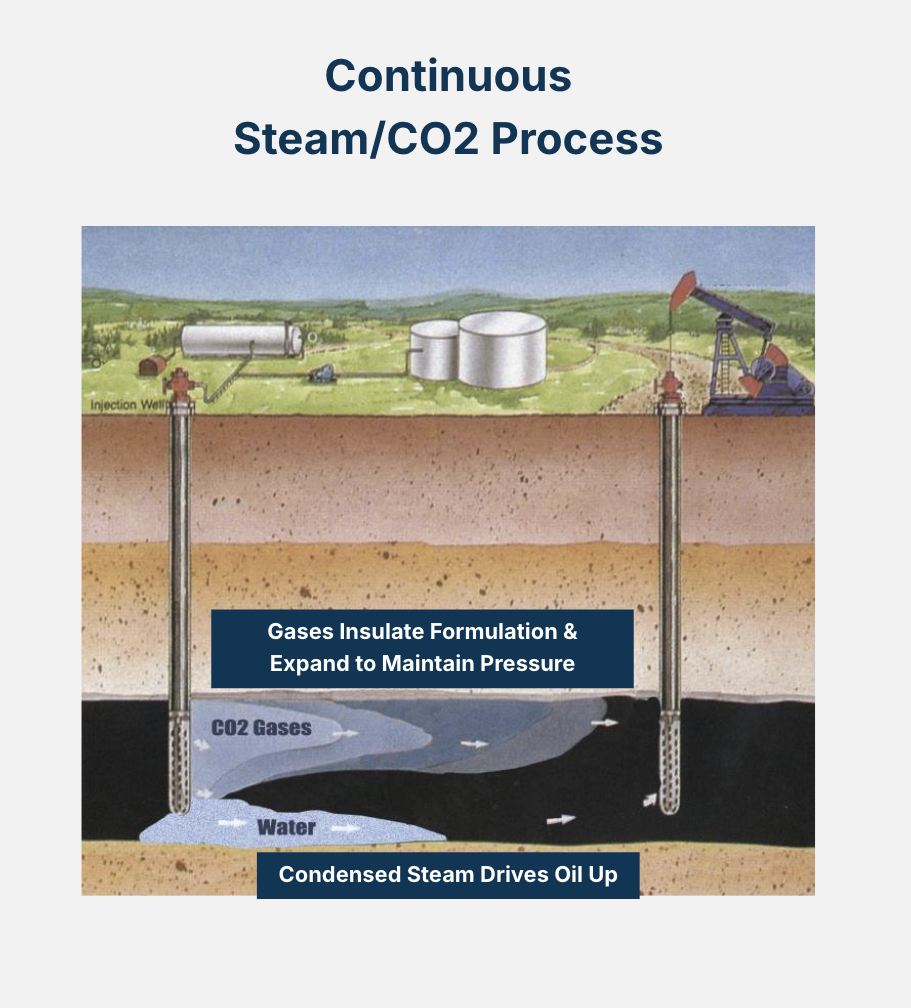

- Electricity, Natural Gas, and C02 lines adjacent to project

- Cheap Electricity

- Unlimited C02 available from Electricity Plant – 40 miles away.

Subsequent Phases: 2,640 Acres

Production within our project boundaries & targeted formations

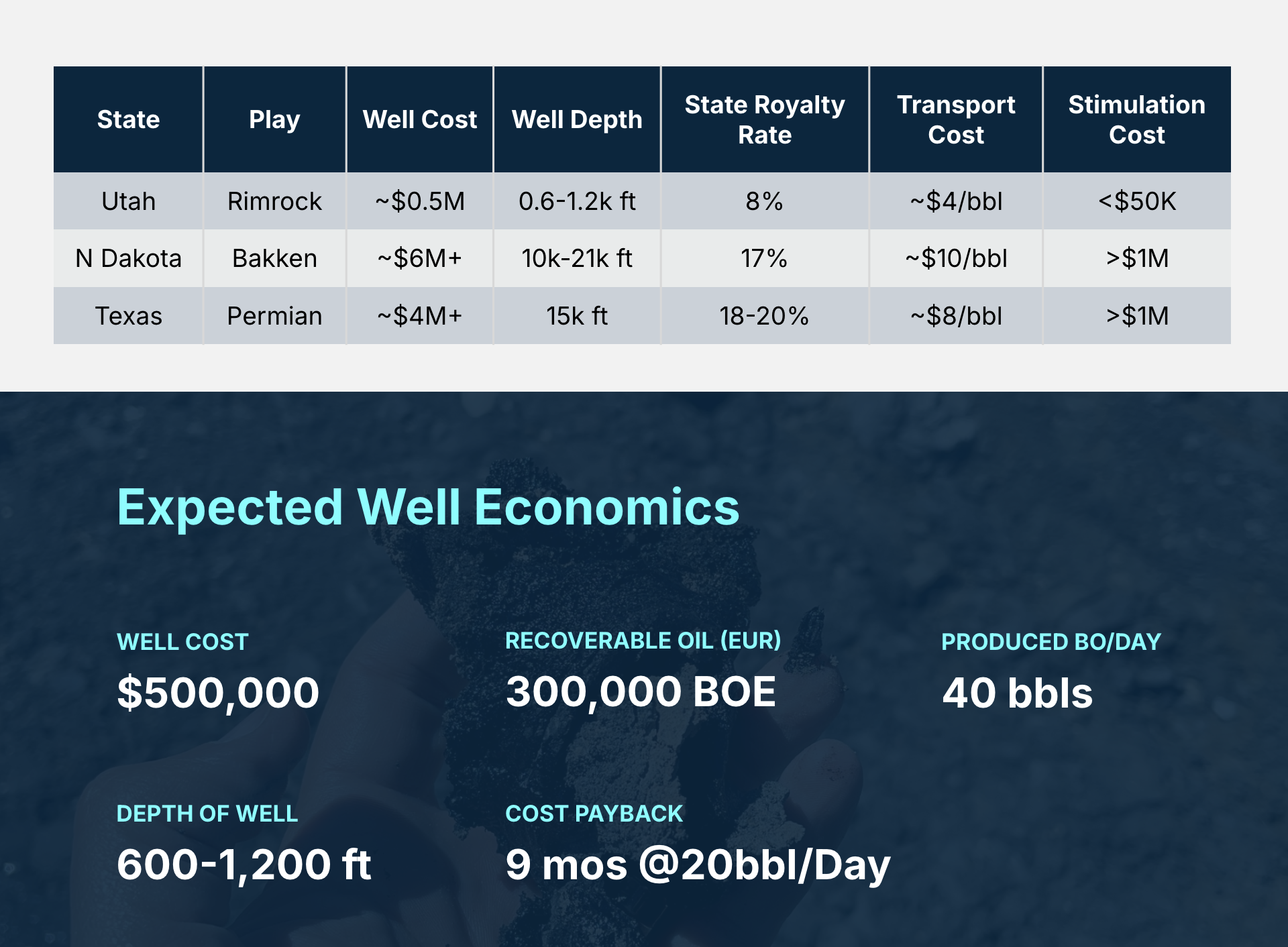

Utah’s Rimrock Asset Offers Attractive Development Attributes

- Low State Royalty Rate

- Low Transportation Cost

- Shallow wells = Less costly drilling costs

- Attractive stimulation costs using Heat/Steam vs. Fracturing process

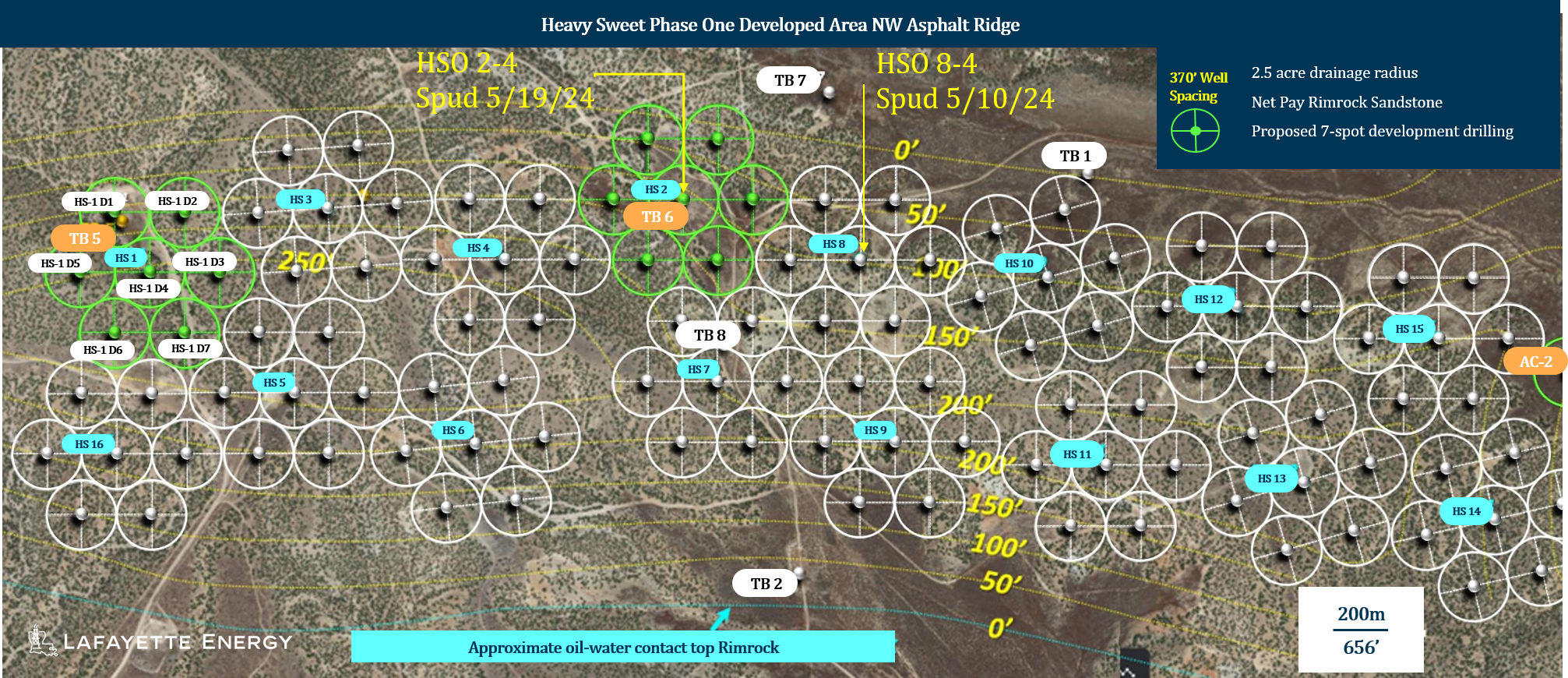

240 Acre Phase 1 Opportunity

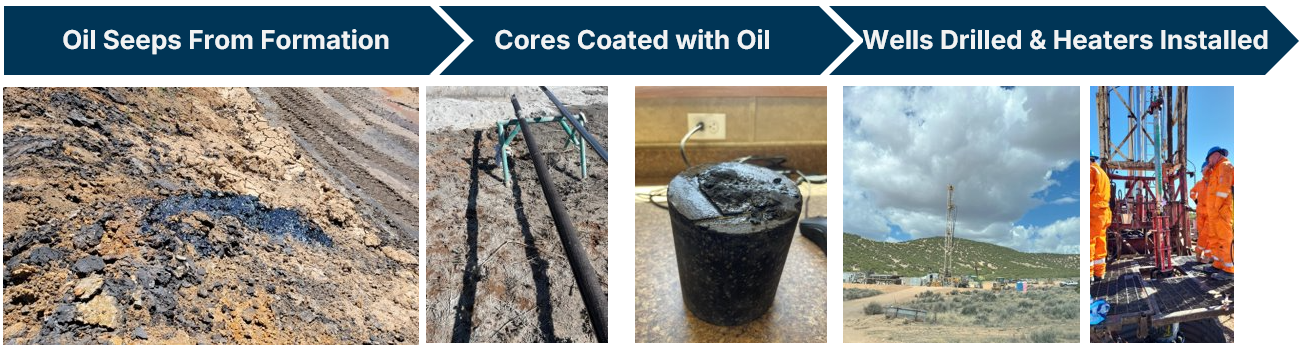

First 2 Wells have been drilled showing average of 150’ of tar sands pay

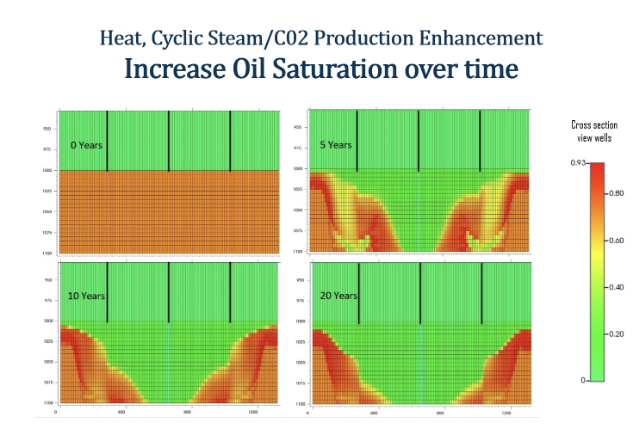

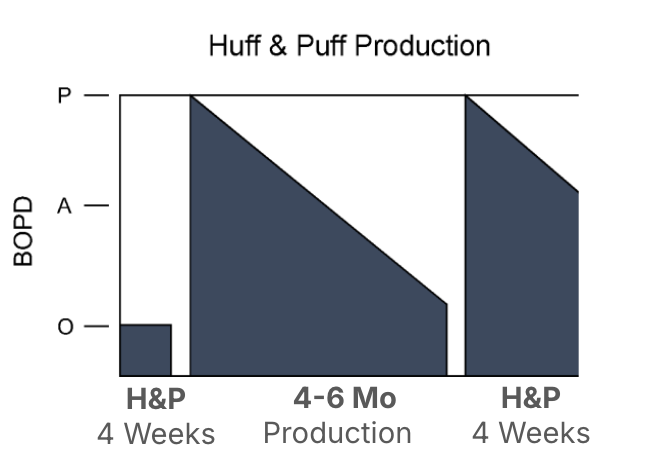

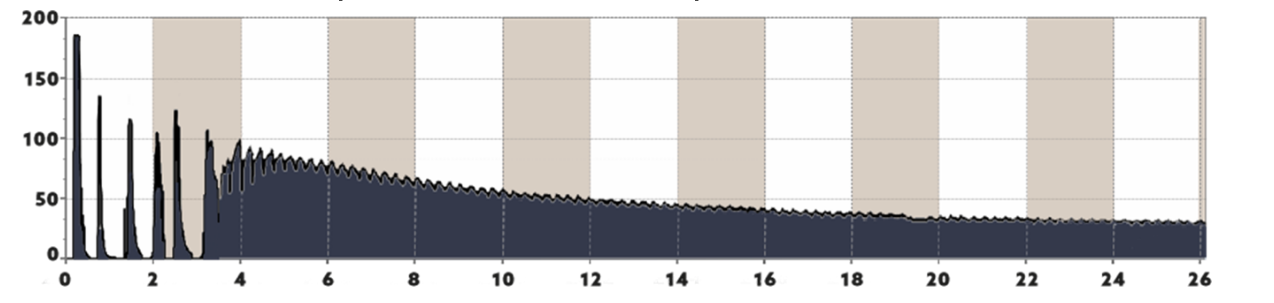

Use downhole heater for first 70,000 bbls, then steam and CO2 for 20-year expected life of well

Heater manufacturer, after review of formation, guaranteed 40 bbls/day before payment required.

Business model uses 40 bbls/day expected production

Phase 1 Development

Wells 1 & 2 Results

1st Well spud on

May 10th,2024

2nd Well spud on

Production proved August 28th, 2024

Multiple Offtake Opportunities

Bitumen for Asphalt

WTI + $15

- Utah Refineries within 3 hours of Site

- Willing to take all production

- No heated tankers needed

- Combined with Carbon Sequestration, could be used as Green Asphalt

Marine Fuel

150% of WTI (Quadrise Technology)

- With SOx and other regulations, Marine fuel is costing upwards of 200% of WTI

- Adding Glycerin and water and Quadrise process to this no-sulfur oil, creates a marine fuel product

- Operator has North American exclusivity for Quadrise Technology

- In discussion with 2 Marine Shipping companies

- Requesting 300 bbls of product to test

- Indicative demand for 60,000 bbls/day @ 150% of WTI

Heavy Oil sold at Market

150% of WTI (Quadrise Technology)

- Processed on Site

- Trucked/Rail to Cushing or

LA refineries - Transportation expected

to be $10/bbl

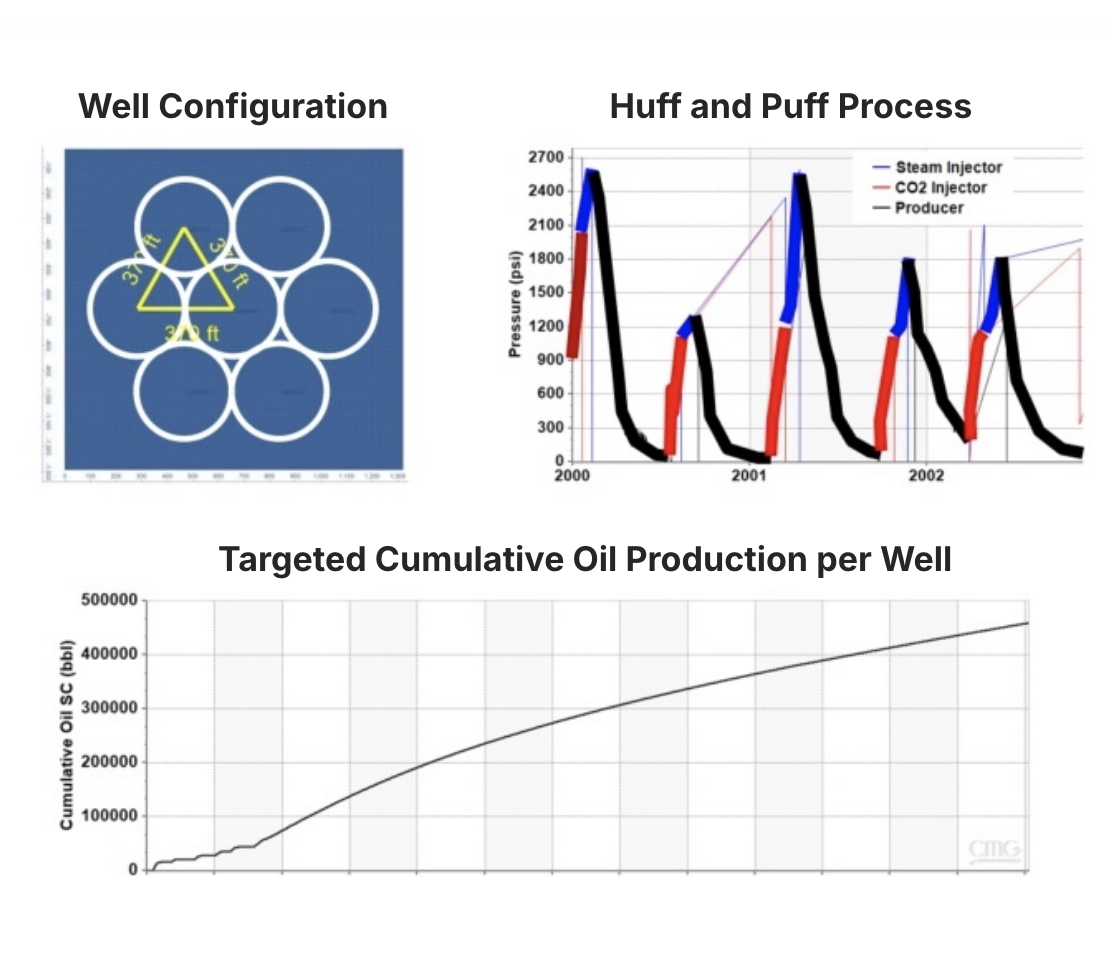

Well Production Model

150+ ft

Thick average pay zone across two zones – Rimrock & Asphalt Ridge (HSO 2-4 190’ thick)

2.5 Acre

7-Well Hexagonal Spacing

Heat initially in all wells

Steam in middle for 20 years

500 to 2500 ft

Target In-Situ Oil Sands

40% -60% Recovery

Targeted recovery yields

500.000 bbl per well

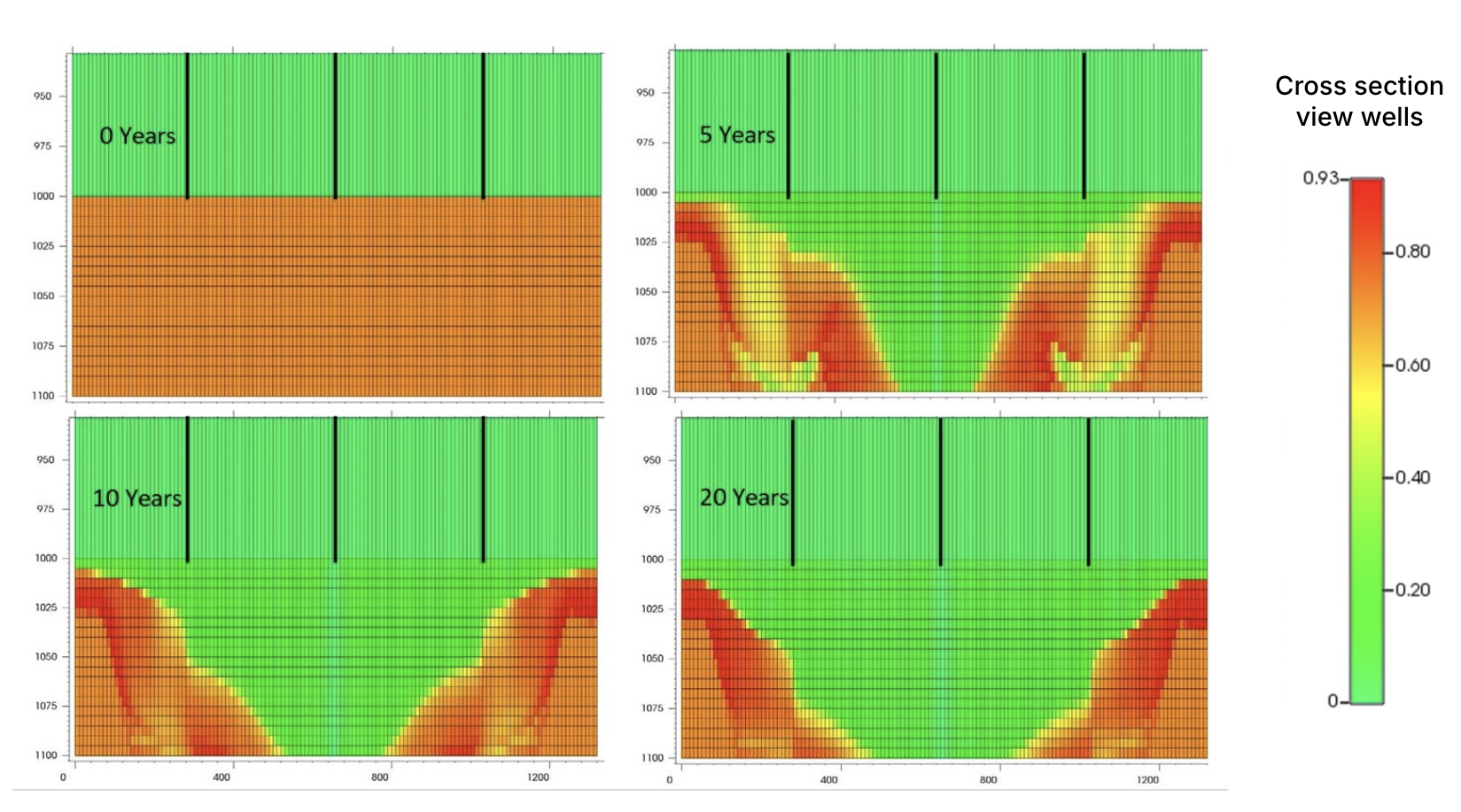

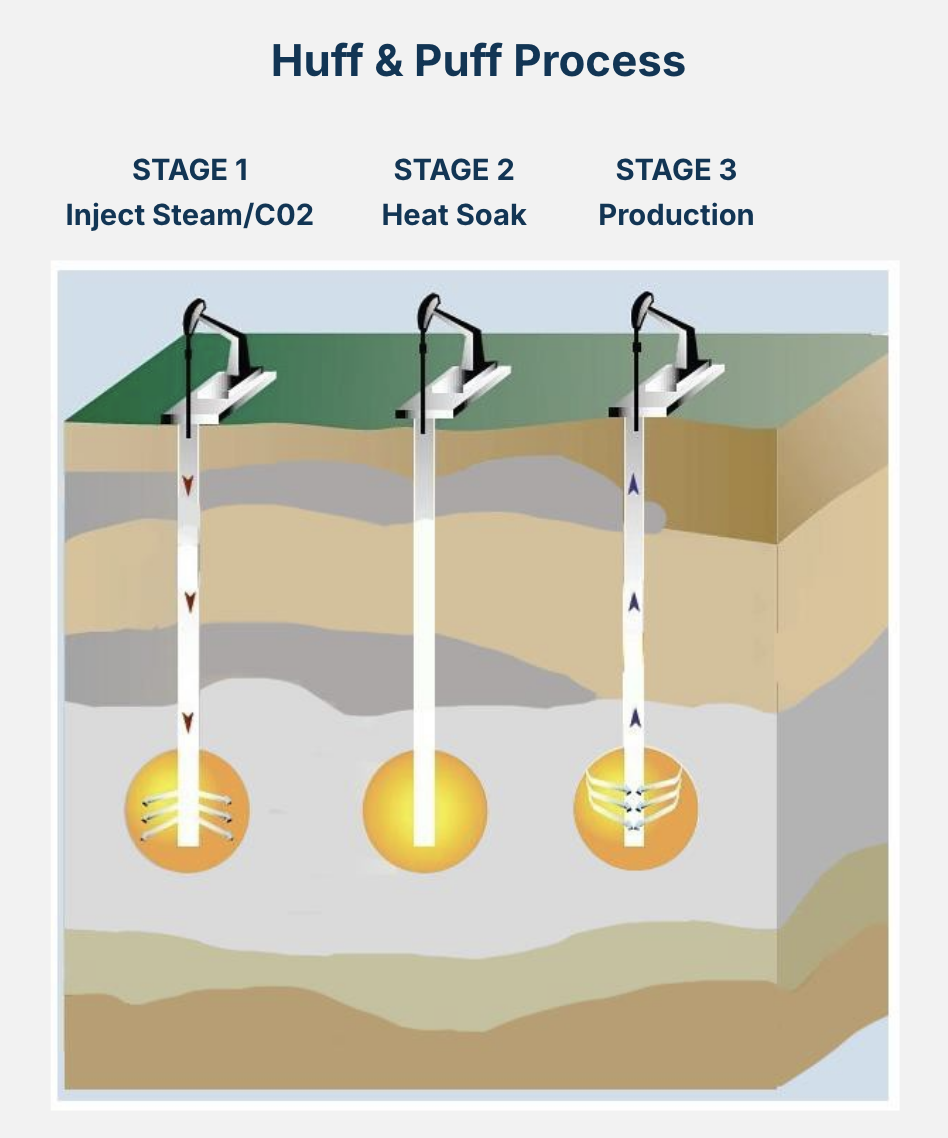

Cyclic Steam/C02 Production Enhancement

Cyclic Steam/C02 Production Enhancement

Heat, Cyclic Steam/C02 Production Enhancement

Increase Oil Saturation over time

Investment Strategy

Planned Fast Growth Plan

Disclaimer:

Offtake agreements may not be available at 150% WTI. A RBL may not be able to be secured or at satisfactory rates. It will be impossible to determine how long it would take to recover total reserves because during the life of the well due to downhole or mechanical problems. In other words, we cannot guarantee the initial flow rate to depletion or operation cost to produce oil.

Use of IPO Offering

Proceeds :

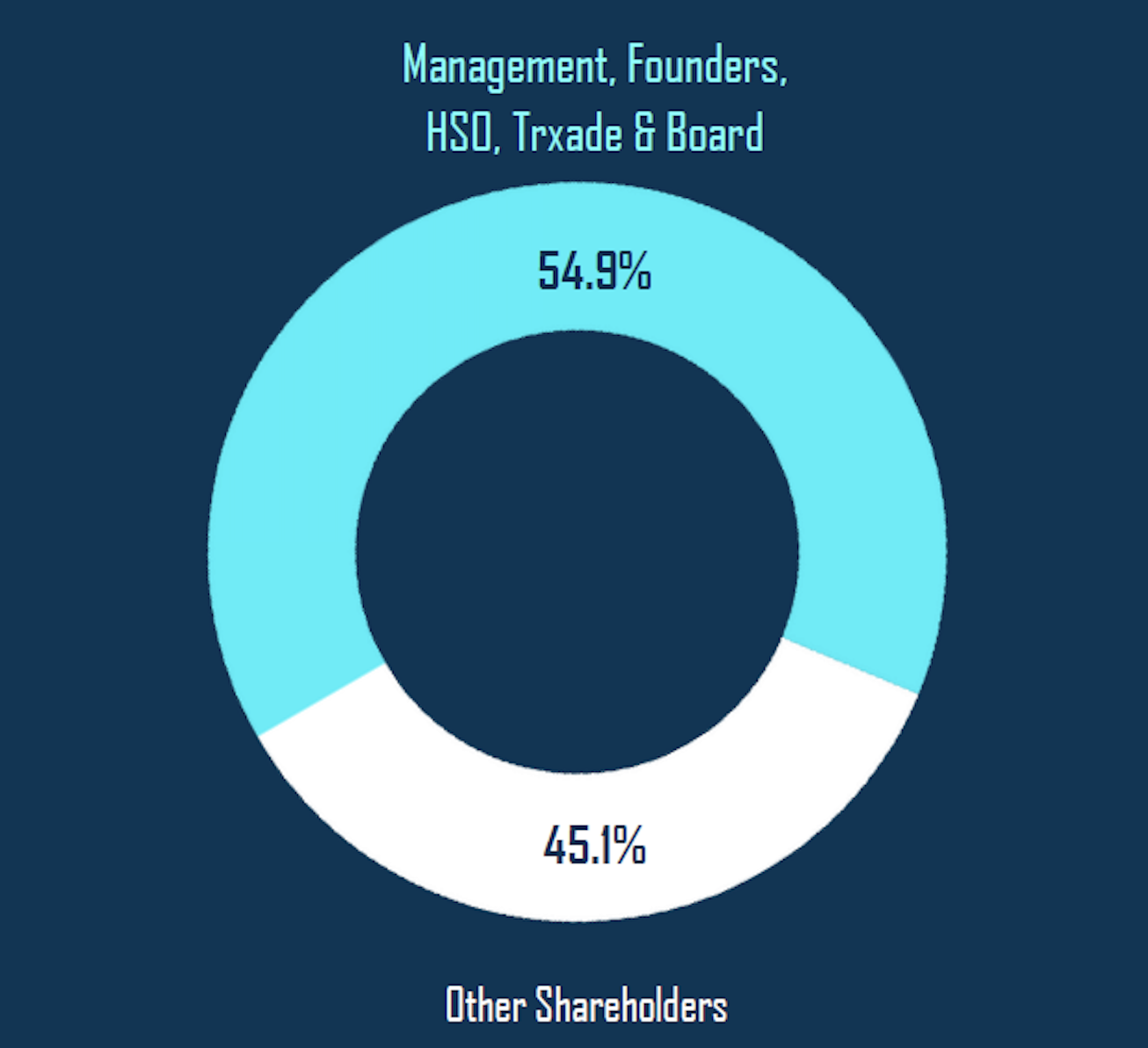

Share Structure & Ownership

| Name of Investor | Shares | % |

|---|---|---|

| Michael L. Peterson, CEO & Director | 1,301,646 | 8.6% |

| Frank C. Ingriselli, Chairman | 880,000 | 5.80% |

| Gregory L. Overholtzer, CFO | 100,000 | < 1% |

| Michael Schilling | 1,095,000 | 7.2% |

| Adrian Beeston | 1,183,334 | 7.8% |

| Naia Ventures | 1,100,000 | 7.2% |

| Trxade, Inc.* | 1,000,000 | 6.6% |

| Heavy Sweet Oil LLC | 2,688,000 | 17.7% |

| Other Shareholders and Investors | 4,464,399 | 38.5% |

| Total | 13,812,379 | 100% |

*NOTE: Assumes Trxade, Inc. is fully converted to common

Opportunity & Goal

Be First to Develop the Largest U.S. Tar Sand

Build a Billion Dollar Company within 5 years